When you pass away your loved ones will be left without you but they will also have a multitude of time critical decisions to make. You can help ease the transition by having these four documents prepared now.

My mother passed away a few weeks ago and her preparedness has shown me how ill-prepared my husband and I are if anything should happen to us. There are loads of legal and financial decisions I have to make now despite the fact that she had much of this already done.

Note: I am in the United States. Laws may be different in other countries and even in this country they vary from state to state.

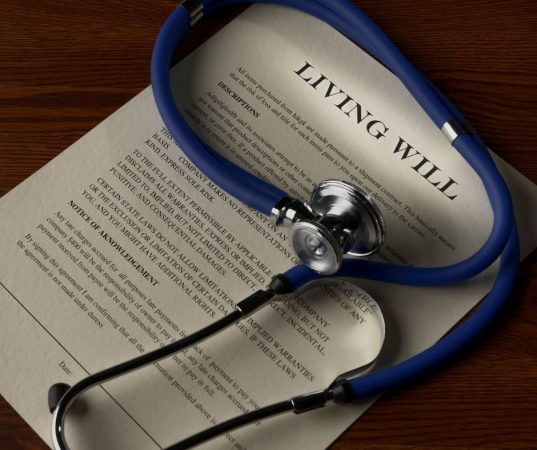

Advanced Directive / Living Will / DNR

An Advanced Directive will spell out what medical care you want provided if you are not able to communicate your wishes and who will make the decisions in your place.

The good news is you probably don't need a lawyer to create one. Google "create an advanced directive in STATE" or ask your doctor.

After creating it, make sure the person who is supposed to make the decisions has a copy and that other people know what your wishes are.

There was a little kerfuffle before my Grandfather passed and one of my uncles was not ready for them to disconnect him from life support even though that's what he would have wanted. While Mom may have given me the wrong page of the advanced directive, we all knew that she had a "do not resuscitate" (DNR) completed so I could direct the hospital staff without any repercussions or guilt.

More information on FamilyDoctor.org.

Funeral Preplanning

When Mom made the arrangements for my Dad after he passed she went ahead and made her own as well, and she paid for as much of it as was legally allowed. There will still be fees that have to be paid at the time of death (namely ordering the 18 gazillion certified copies of the death certificates your beneficiaries will need to file).

The nurse at the hospital nervously asked me about where I wanted Mom's remains sent a short while after we said our final goodbyes. I was able to pull out the paperwork from the funeral home and she was on her way within hours. No stay in the morgue while I scrambled to figure things out in my grief.

It may make you uncomfortable to think about your own funeral, but if you don't make the decisions someone else will have to do it for you after you die while they are in mourning and critical decisions need to be made immediately.

If you do not have the money to prepay for your funeral at least write down anything you really want or don't want. I know my mother would have haunted me from the great beyond if I dressed her in pink and had an open casket funeral. If you want them to sing On Eagle's Wings at your service, write it down! Cremation? Military funeral? Write it down!

More information on funeral preplanning the National Funeral Directors Association.

Will and/or Living Trust

I am not a lawyer and I do not have either a will or a Living Trust in place. We will very soon. So I am not actually qualified to tell you this. But I will anyway:

Get a Will and/or Living Trust done ASAP. Especially if you have children or own property.

Short very simplified explanations of a will versus a living trust:

Will: details how your estate will be handled after death includes provisions for care of minor children. Goes through Probate.

Living Trust: your assets are placed in a "trust" that is administered by a trustee, which can be yourself. Upon your death a successor trustee takes over. Does not need to go through probate.

Probate can lock up the assets (money and property) for up to 2 years if there is no Will.

Here in California there is a 45 day wait after a person dies to access funds or close out a deceased person's checking or saving's account. Other states it is only 30 days. If that account is in a Living Trust it makes things faster and easier. Or so they tell me. Trying to do it with a Living Trust in place is complicated enough if you ask me.

But, if you don't have a Will or Trust and you don't prepay for your funeral then your beneficiaries will have to. And they will have to pay any outstanding bills, mortgages, etc. And it will have to be from their own funds while they wait to be paid back from your estate.

Every person's situation is different and it can change as your life circumstances change. I highly recommend sitting down with an Estate Planning Attorney to help you decide what is best for your situation. Yes, this one will cost you money, but it is worth it.

More information on Nolo.com

"What to Do After I Die" Page

I just made that fancy name up, but my Mom had one sheet of paper with all of the relevant accounts, phone numbers, websites, etc. on it and it has made things much easier for me.

And, yeah!, this one is absolutely free to create. Either electronically or with good ole pen and paper write down the following:

- bank account numbers

- life insurance policy information

- utility company accounts (including cable, Roku, Netflix, etc. and other regular monthly bills)

- mortgage/rental account information

- computer passwords and pins

- your physician's name and contact information

- contact information for accountant, lawyer and financial planner

- where to find your will/trust

- your social security and driver license numbers

- account information for anything else that will need to be cancelled

If you are married and one of you handles the finances for your family then you definitely need to do this! I can only imagine if my husband had to try to make sense of all of my scrambled bookkeeping and passwords.

Keep the file up to date. Hide it and tell two people you trust where to find in case of your passing. Mom had hers in a lock box hidden in a closet and I had a duplicate key.

Do it NOW!

Do your family a favor and get these documents in place now. It could save them a great amount of time and frustration later on and you will rest easy knowing they won't have to deal with the stress of handling all of the final arrangements while mourning your loss. And if your parents or other older relatives are still living, sit down with them and discuss their final plans as well.

Leave a Reply